Have you heard the saying, "Low risk, low return?" Stocks that go up and down less than the market have low risk (low beta) and should offer lower returns than high-beta stocks. This is the common-sense relationship between risk and return predicted by the capital asset pricing model (CAPM), which most professionals would use to manage your money.

The truth may surprise you.

Real-world data contradict CAPM's predictions. A paper titled Country and Sector Drive Low-Volatility Investing in Global Equity Markets finds that a portfolio of low-risk stocks formed from the cap-weighted MSCI World Index has a return that is higher than that of the index itself.

From 1978 to 1996, the low-risk portfolio had a return of 18.5% (Sharpe ratio 0.98), while the index had a return of only 15.0% (Sharpe ratio 0.56). From 1997 to 2012, the low-risk portfolio had a return of 9.6% (Sharpe ratio 0.74), while the index had a return of only 5.5% (Sharpe ratio 0.17).

It's worth pointing out that it's easy to beat the cap-weighted index, despite what some experts say. Even picking stocks randomly will do it. But one of the few things worse than a cap-weighted index is a portfolio made up of high-risk, high-beta stocks. (See Equal-Weight Benchmarking, p. 3.)

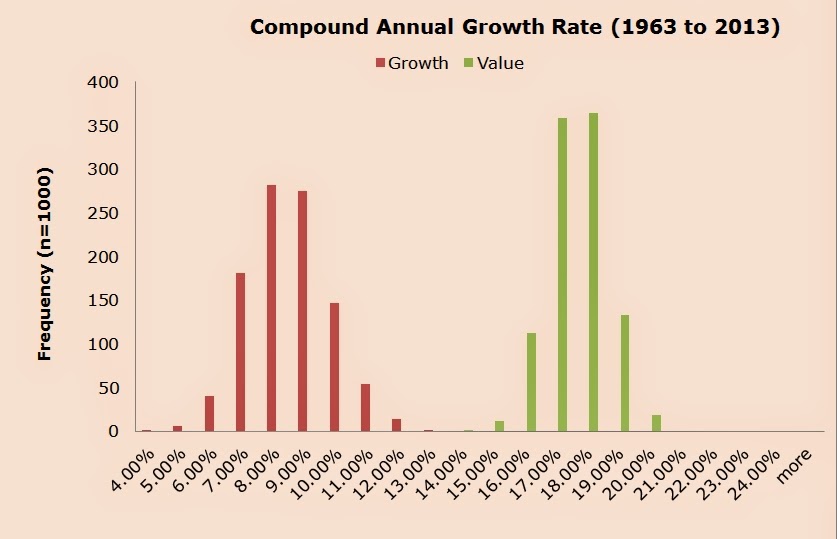

The chart below, taken from the paper, explains why the low-risk strategy works.

The low-risk portfolio, represented by the tan bars in the chart, has a beta of 51%, meaning that when the index goes up or down, it should move 51% as much as the index does. "Low risk, low return," right?

But the chart shows that this isn't actually what happens. When the index goes up, the low-risk portfolio goes up more than its beta says it should, as reflected in the upside capture of 64%. The return is 1.25 times what it's "supposed" to be.

When the index goes down, the low-risk portfolio goes down less than its beta says it should, as reflected in the downside capture of 32%. The loss is only 0.63 times as large as it's "supposed" to be.

The low-risk portfolio outperforms the index over a long period of time

because it outperforms its beta in both up and down markets.

(The blue bars in the chart shows that the low-risk strategy also works if you group the stocks by country and sector first and then build a portfolio based on the lowest-risk country/sector combinations. The paper describes this in more detail.)

A spate of articles has come out recently saying that low-risk portfolios haven't worked in the past few years, since their return has been lower than the market's return. To evaluate these criticisms, look at the beta of a low-risk portfolio. If its beta is 50%, it is half as risky as the market, and it should only provide half the return (assuming interest rates are near zero). If its return is higher than half of the market's return, the portfolio is doing what it's supposed to.

Low-risk stocks do better than stocks as a whole because their return is only slightly lower in bull markets and is much better than average in bear markets.

Some people use leverage, borrowing money at a low rate, to be able to buy a larger amount of a low-risk portfolio, making its beta equal to that of the index. Since the low-risk portfolio already has a higher long-term return than the index does, leverage increases that return even more.

Common Sense is Not Common True

If you need more evidence, look at the chart below, taken from a paper titled The Volatility Effect: Lower Risk Without Lower Return. The chart has a line moving upward from left to right showing a low return for low-risk (low beta) stocks. The line was drawn using predictions from CAPM.

There's nothing in the chart that would surprise most financial professionals. The problem is that I cheated.

It's not actually the chart taken from the paper. I erased the real-world data before showing it to you.

Here's the real chart:

The data points don't fit the line at all. In fact, they seem to trend in the opposite direction. Low-risk, low beta portfolios have higher returns than high-risk, high beta portfolios.

A paper titled Betting Against Beta shows that low-risk assets outperform their betas for U.S. stocks, 20 international markets, the Treasury bond market, the corporate bond market, and the futures markets.

The paper hypothesizes that low-risk works because of mutual fund managers. They try to outperform the market, but they're not allowed to use leverage, so they buy high-risk stocks instead. This drives up the price of high-risk stocks, causing a drag on returns, while leaving low-risk stocks underpriced.

The authors of the paper look at actual portfolios to test their hypothesis:

We study the equity portfolios of mutual funds and individual investors, which are likely to be constrained. Consistent with the model, we find that these investors hold portfolios with average betas above 1. On the other side of the market, we find that leveraged buyout (LBO) funds acquire firms with average betas below 1 and apply leverage. Similarly, looking at the holdings of Berkshire Hathaway, we see that Warren Buffett bets against beta by buying low-beta stocks and applying leverage.Mutual funds hold risky, high-beta stocks. Warren Buffett, on the other hand, buys low-risk, low-beta stocks and applies leverage, accessing money at favorable terms so he can buy more.

People think leverage is risky, but risk depends on what the leverage is buying. The data suggest that using leverage to buy low-risk stocks is a better idea than buying high-risk stocks without leverage. An alternative, sort of like using leverage, is to change a portfolio over to low-risk stocks and to use more of the portfolio than normal for stocks and less for bonds.

Another way to invest in low risk, discussed in a paper titled Capitalizing on the Greatest Anomaly in Finance with Mutual Funds, is to buy funds with low betas.

There are also specially-designed low-risk exchange-traded funds that can be bought and sold like individual stocks. They have favorably low expense ratios. However, retirement accounts typically have limited choices that may not include these funds.

Be Brave

What we've discussed may make financial professionals uncomfortable. The low-risk, high-return phenomenon has been known since the 1970's, but people are still taught the capital asset pricing model in school, and they still use it to manage money.

Strategies with academic research behind them, like low-risk investing, value, and momentum, get ignored in favor of passive investing. Beating the market is said to be hard, despite evidence that a cap-weighted market index like the S&P 500 historically has been beaten by picking stocks randomly.

If you challenge the capital asset pricing model, you challenge what people were taught in school. You challenge what they do for a living. You challenge their worldview.

Think different. Be brave.